How to Open a Prop Trading Firm: The Ultimate Guide to Launching a Successful Business in Financial Services

Establishing a proprietary trading (prop trading) firm is a compelling venture within the financial services industry, offering entrepreneurs an opportunity to capitalize on market movements and deploy innovative trading strategies. This comprehensive guide aims to provide a detailed roadmap on how to open a prop trading firm, covering every essential aspect from legal requirements and funding to operational setup and compliance. Whether you are an experienced trader aiming to expand into entrepreneurship or an aspiring financial professional seeking to enter the lucrative world of prop trading, this article offers insights to navigate the complex landscape efficiently and confidently.

Understanding Prop Trading and Its Revenue Potential

Proprietary trading involves trading financial instruments with a firm's own capital, aiming for profit rather than commissions from clients. Unlike traditional asset management or brokerage services, prop trading firms generate income by executing trades based on sophisticated strategies, proprietary algorithms, and expert traders’ insights.

This business model has seen exponential growth thanks to technological advancements, increased access to sophisticated trading platforms, and the availability of extensive market data. Successful prop trading firms can generate significant revenue, but it requires a strategic approach, proper setup, and ongoing management.

Step-by-Step Guide on How to Open a Prop Trading Firm

1. Conduct a Thorough Market Research and Business Planning

Before diving into the operational aspects, it is vital to perform in-depth market research to understand industry trends, competitors, target markets, and potential niches. Developing a detailed business plan helps clarify your vision, define your unique value proposition, and outline your operational model.

- Identify your niche: Equity, forex, commodities, or multi-asset trading?

- Understand regulatory environment: Each jurisdiction has different rules governing prop trading firms.

- Assess capital requirements: How much initial funding will you need?

- Define your trading strategy: Quantitative, discretionary, or hybrid?

- Plan your organizational structure: Traders, risk managers, compliance officers, and support staff.

2. Choose the Right Jurisdiction and Legal Structure

Legal considerations are crucial when setting up a prop trading firm. Jurisdiction determines regulatory requirements, taxation, licensing, and operational ease.

- Popular jurisdictions: United States, United Kingdom, Singapore, Cayman Islands, and Australia.

- Legal structures: LLCs, corporations, or partnerships—select the one that aligns with your business goals and compliance needs.

- Licensing and Registration: Depending on your location, you may need to register with financial authorities such as the SEC (SEC for US), FCA (UK), or ASIC (Australia).

- Legal Advice: Engage a legal professional specializing in financial services to ensure full compliance and robust contracts.

3. Secure Adequate Capital and Funding

Funding is a primary consideration. Whether you are self-financed or seeking external capital, ensure you have enough to cover trading capital, operational costs, technology infrastructure, and contingencies.

- Source of funding: Personal savings, angel investors, venture capital, or partnerships.

- Capital requirements: Usually, a minimum of $500,000 is recommended to start with, though it varies based on your trading scope and goals.

- Risk management: Establish a clear risk cap to avoid excessive losses and secure your capital.

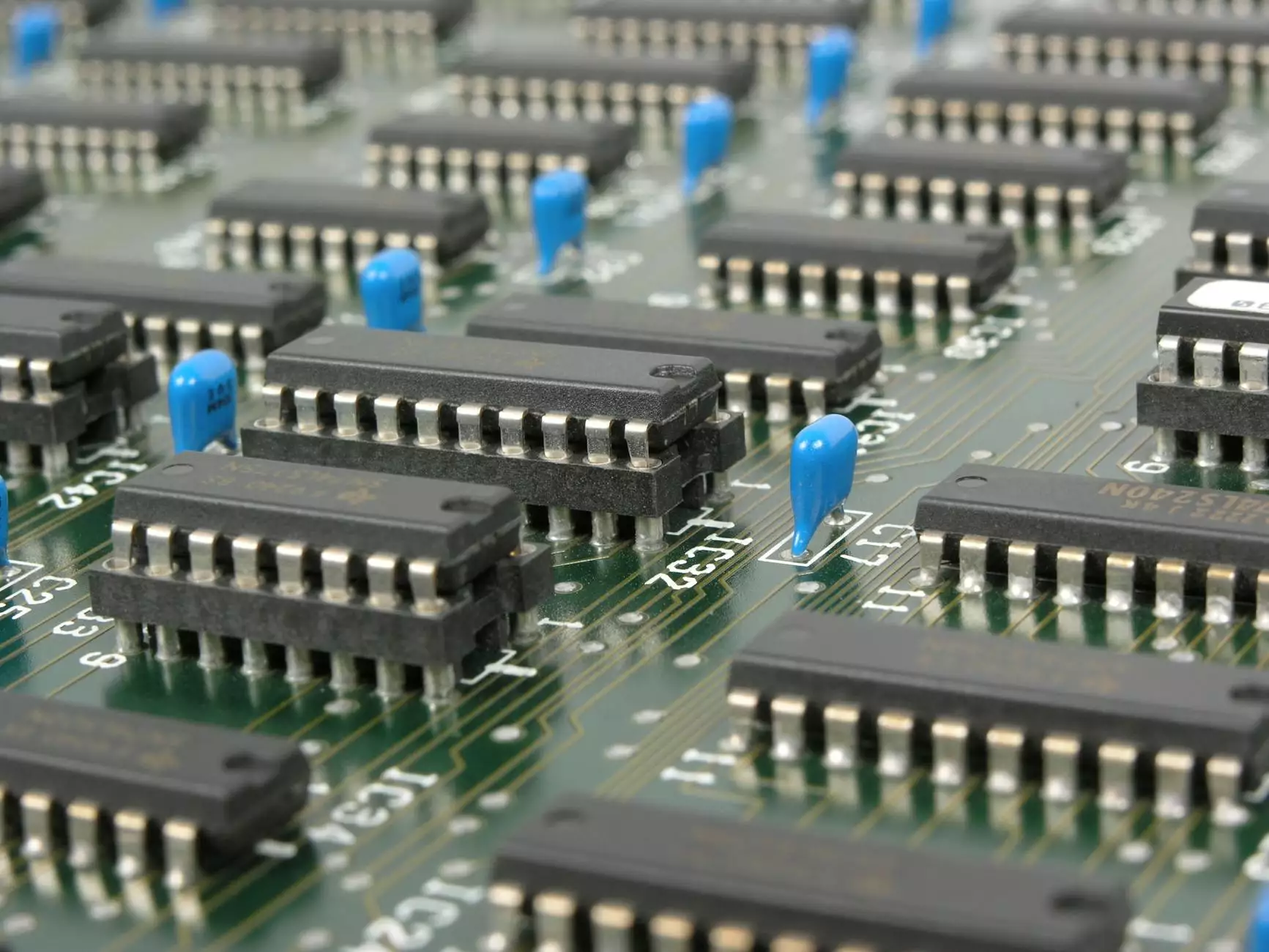

4. Establish Robust Infrastructure and Trading Technology

Technology plays a pivotal role in prop trading success. Your infrastructure must be reliable, fast, and secure to execute trades efficiently and effectively.

- Trading Platforms: Select powerful platforms like MetaTrader, NinjaTrader, ThinkorSwim, or custom-built solutions tailored for high-frequency trading.

- Data Feeds: Real-time market data providers ensure your traders have the latest information.

- Order Execution: Establish direct market access (DMA) or ECN connections to minimize latency.

- Infrastructure: High-speed internet, dedicated servers, backup systems, and cybersecurity measures.

- Analytic & Risk Management Tools: Incorporate analytics software and risk management systems to monitor performance and control exposure.

5. Hire and Develop a Skilled Trading Team

The heart of any prop trading firm is its traders. Building a talented team requires careful recruitment, training, and ongoing support.

- Recruitment: Look for experienced traders with proven track records, analytical skills, and discipline.

- Training and Development: Constant education on market trends, new strategies, and compliance requirements.

- Incentives: Create competitive compensation schemes, profit-sharing, and performance bonuses to attract and retain top talent.

- Culture: Foster a risk-aware, collaborative environment to promote continuous improvement.

6. Implement Risk Management and Compliance Protocols

Effective risk management prevents catastrophic losses and ensures business longevity. Compliance ensures adherence to legal standards and industry best practices.

- Risk controls: Position sizing, stop-loss orders, daily loss limits, and diversification strategies.

- Compliance: Establish policies for trading disclosures, record-keeping, and reporting obligations.

- Audits and Monitoring: Regular audits to detect irregularities and ensure adherence to regulations.

- Trade Surveillance: Use software to monitor trading activity for insider trading, market manipulation, or other violations.

7. Market and Start Trading

Once all foundational elements are in place, commence live trading. Start small to test systems and strategies, then scale gradually.

Constantly analyze performance data, refine strategies, and adjust risk parameters. Document lessons learned to foster continuous growth.

Additional Tips for Success in Financial Services and Prop Trading

- Build a Strong Network: Connect with industry peers, attend financial conferences, and participate in trading communities.

- Leverage Data Analytics: Use big data and AI-driven analytics to stay ahead of market trends and improve decision-making.

- Focus on Education: Stay updated with regulatory changes, new trading strategies, and technological innovations.

- Prioritize Ethics and Integrity: Uphold transparency and ethical standards; this enhances reputation and sustainability.

- Adopt Scalable Systems: Use flexible infrastructure that can grow with your business.

Conclusion: Your Roadmap to Creating a Profitable Prop Trading Business

Establishing how to open a prop trading firm requires careful planning, substantial capital, cutting-edge technology, and a competent team. By understanding the regulatory landscape, developing sound risk management procedures, and continuously evolving trading strategies, you can position yourself for long-term success in the competitive world of financial services.

This venture is challenging yet lucrative. It offers the unique opportunity to leverage skill, technology, and market insights to generate significant profits. Remember, success hinges not just on the initial setup but also on ongoing innovation, strict discipline, and adherence to regulatory standards. With dedication and the proper approach, your prop trading firm can become a leading force within the financial industry.

Get Started Today with Expert Support from PropAccount.com

If you're serious about launching a prop trading firm, partnering with experienced professionals is essential. PropAccount.com offers comprehensive solutions tailored to financial services businesses, including legal consultation, technology infrastructure, funding options, and strategic planning. Contact us today and take the first step toward building your profitable trading enterprise.